Avoiding High Interest Payments on Multiple Loans

When you first went to college, your focus with regards to student loans was likely simply getting the money to cover tuition. After all, at that point payments were at least four years away – right? Of course you did some research before taking the plunge, opting for the subsidized loans where you could… and the unsubsidized ones when you had to.

Taking on multiple loans throughout your college career has its benefits and drawbacks, but what they never told you in the student loan office was how to take care of your debt when you finally got out of school. Luckily, we’re experts on that – especially when it comes to avoiding high interest payments. In this post, we’ll show you the truth in getting help with student loans and keeping those interest payments down.

Get a head start during the grace period

There’s nothing like 6 months of $0 payments to make you forget about all the interest compounding on your loans, day by day. Don’t be lulled into complacency; this is not the time to forget about school. It’s the time to make your plan of action. Although the grace period gives you some time to start earning before your payments start, the interest that builds up during that time will make your payments higher in the long run.

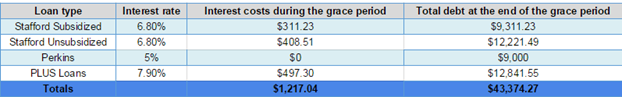

Need some proof? Just look at the interest that accumulates on $36,000 worth of debt in just 6 months (see the chart below)

For this example, we’re using $9,000 of debt on each of these 4 loans:

It’s an expensive grace period to say the least… which is why we like to recommend that if you have 3 or 4 student loans to take care of after graduation, out of the different student loan options, consolidation during the grace period is a great option.

Why is consolidation a great option?

Not only does it make your bill paying easier, it also:

- lets you make the minimum monthly payments on your loans for 3 months while you’re engaged in the consolidation process

- lets you know what your payments are going to look like, so you can plan ahead

- gives you the option of getting into a lot of good programs that can lower your monthly payments based on your current income

And here’s a great insider’s secret you can use after consolidation if you don’t think your future income will let you repay your loans in full:

Through the income-based repayment program (PAYE), you can have the remainder of your debt forgiven at the end of the 20 – 25 year program. I know that sounds like a long time…but at least this way you can guarantee you won’t be shackled for life with debt if your income isn’t enough to repay your loans.

We can help!

To learn more about this and other ways you can save time, money and hassle, get in touch with our student loan specialists at (877) 927 – 6859. The call is free. Or learn more for help with student loans at www.studentloanservice.us